This is a summary of episode 3, where we discuss ways to save on flights and airline-related expenses. All relevant links from our discussion are posted below!

Table of Contents

Tips for Saving on Airfare

Sign up for Airline Programs! There are a few reasons to do this. First, when you go to book your flight, all of your information (including TSA PreCheck/Global Entry numbers) will auto populate, eliminating errors and wasted time. Each flight you book will also begin to accrue points within the airline’s loyalty program, one of the best ways to get free flights in the future. Some airlines will even deposit miles in your account just for signing up for their program! By signing up, you also will be alerted to airfare sales and award discounts via email. Store all your airline loyalty numbers in a note on your phone for quick reference should you need them later.

Perhaps the most important reason to create an account ahead of time is if you have credit card points you want to transfer to these airlines. Sometimes signing up for a program right when you want to transfer credit card points can delay the transfer, and then your great deal disappears before you can book and all your previously flexible points are stuck in the airline program.

Loyalty vs. Flexibility! There are major benefits to using one airline for all of your travel. You will earn miles much faster than if you spread your flights between different airlines, therefore you’ll earn free flights much faster. You will also reach airline status tiers faster. Airlines have different levels of status that come with better perks the more you spend with them. Usually the first tier comes with priority boarding, one free checked bag, access to better seating, enhanced customer service, and more, so it definitely can pay off to put all your spend on the airline you love and see them return the love!

Flexibility on the other hand allows you to see which airline is offering the best deal, potentially saving you a lot of money. This may come in handy if you fly out of an airport that isn’t a hub for a specific airline or you really don’t care which carrier you fly. O’hare is a hub for United Airlines, so most of the time I will save money by booking through them versus a competitor like Delta, but I always check before booking just in case a better deal exists elsewhere. The best approach can sometimes be having a preference for where your loyalty dollars are going, but being willing to switch airlines if the price differs more than a few dollars between programs.

Look for Program Sales! You can save a lot of money by paying attention to marketing emails from airlines! They usually alert their customers to both cash and mile discounts. You can really see how this would pay off if United announced discounted economy fares from LGA to LAX for the dates of your audition or Southwest announced a 50% sale on mile purchases when you were a few hundred miles short of a round-trip flight redemption. We will be sending out a weekly newsletter about current airfare and hotel sales, so be sure to sign up above!

Credit Cards Are Not Inherently Evil! Look, we just have to say this: Credit cards are not going to bankrupt you if you are responsible with your finances. If you currently have credit card debt, do not get another credit card. The best advice I ever got was never spend more than what is currently in my checking account. This helps to curb the temptation to overspend on your cards. As long as you’re paying yourself first via savings accounts and/or a retirement account (yes, even you young people), your disposable income can become a powerful tool when leveraged with a strategic credit card. In this case, it might be wise to get a $95/yr airline credit card simply for the free bag it gets you (most airlines are charging $35 one-way for a checked bag these days). For you violinists/violists, if you get the $95/yr United card, even if you book a Basic Economy ticket you get a free carry-on AND personal item, one free checked bag, and you board in Zone 2. You can see how this would save you a lot over time. If you want some pressure-free advice on which cards might be best for you, consider scheduling a free consultation with us.

Mile Sales are like “Credit Cards Lite”! If you are credit card averse or you have credit card debt currently, buying airline miles in small amounts can help you play the points & miles game without having to get a credit card. Let’s say you’re a little short on miles for what would otherwise be a $500 cash flight. Buying a few hundred miles for $100 cash is getting you a discount on that flight without having to transfer points from a credit card or open a new card for the sign-up bonus. Check back soon for a detailed “How-To” on miles redemptions and credit card point transfers.

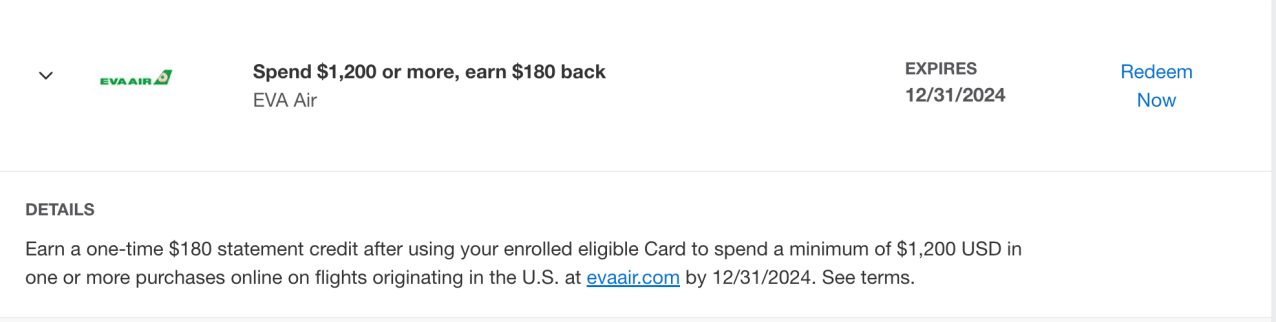

Check Your Credit Cards for Rebates! A lot of credit cards offer limited-time deals you have to click to add to your card, like the one pictured below. You can even take this a step further and load up on airline gift cards during your rebate period for future use! Of course, always check the T&C to see if gift cards qualify for the rebate.

Consider paying for lounge access if you travel often! Services like Priority Pass can save you a lot of money in the long run if you’re the type of person who spends a lot at the airport! Priority Pass offers access to lounges around the world so you can eat, drink, and relax for free! Check if your credit card covers this service or allows you access to an airline lounge a few time a year (like the United Explorer card or the Delta Reserve Amex).

TSA Precheck and Global Entry save you a lot of time! Another thing you might want to do is get Global Entry because it includes TSA PreCheck. PreCheck will expedite your experience within the US and Global Entry will expedite customs on your way back into the US! This is very useful even if you travel only a few times a year (which we all know isn’t the case for us frequent flyers!). Global Entry is around $40 more than PreCheck alone, so at $120 for 5 years it seems like a no-brainer to us! This is another benefit your credit card may offer once every couple of years, so make sure to check before purchasing!

Book earlier flights to save money AND avoid delays! You may have noticed the cheapest flights always seem to be those 5 AM “Kill me now” flights. Well, if you’re willing to struggle through that 2:30 AM wakeup, you also may be saving yourself a huge headache by leaving early in the day! Every delay that happens throughout the day will have an effect on the later flights on the schedule, so if your flight is scheduled at 6 PM when a huge storm rolled in at 3 PM, chances are you will be delayed and may not even get out that day! If you have an early flight that gets delayed, you also have a lot more flights throughout the day the airline can help get you on. When you NEED to be at a rehearsal or audition, make sure to arrive earlier rather than risk the avoidable stress of rebooking a flight!

*HEY YOUNG PEOPLE* You can get a 5% discount flying United Basic Economy in the US through Dec. 31st, 2025! Link with details below!

Link your airline programs to other programs you use! Some airlines partner with other businesses to earn you double points on whatever you’re buying. For example, Delta and Starbucks have a partnership where you can earn Double Stars on Delta travel days and miles on reloads of $25 or more to your Starbucks Rewards account. Delta has also partnered with AIRBNB so you can earn 1 Delta mile per dollar spent with Airbnb (excluding taxes and fees) if you click through their partnership link. Starbucks also has the option to link your account to Marriott or Bank of America, where you earn extra Starbucks points when staying at Marriotts or save 2% when using your BoA card.

Lyft and Uber also have partnerships you can earn extra miles/points on. Lyft has the option to partner with Delta, Alaska, or Hilton, and Uber partners with Air Canada Aeroplan and Marriott. If you have the Apple Card, you also can get 3% cash back on Uber and Uber Eats!

The links to join your accounts are below!

Helpful Links

United Discount for Travelers 18-23: https://www.united.com/en/us/fly/mileageplus/young-adult-discount.html

Starbucks Partnerships: https://www.deltastarbucks.com/content/starbucks/en/overview.html

Lyft Partnerships:

https://help.lyft.com/hc/et/all/sections/0978008190-Rewards-and-partnerships

Uber Partnerships:

https://help.uber.com/en/riders/section/promos-and-partnerships?nodeId=c1c3ee20-dee2-46f9-8b94-81dc65ef2802