THANK GOD IT’S HERE. The Tax Series with Taylor Hampton. We know you suck at taxes. We’re bringing you straight facts from a tax professional, so you can take this fat stack of knowledge to your tax preparer (hopefully it’s Taylor DUH) and get a fat ass refund. LFG.

Connect with Taylor Hampton:

We just have to say right off the bat that Taylor is an awesome person who makes taxes fun and approachable (she’s a wizard cuz how is that possible lol), and you really should hire her for a consultation or to do your taxes if you want someone who knows what they’re doing.

Taylor Hampton, Tax Professional

Business Website: https://www.hamptontaxes.com/

Business Email: <taylor@hamptontaxes.com>

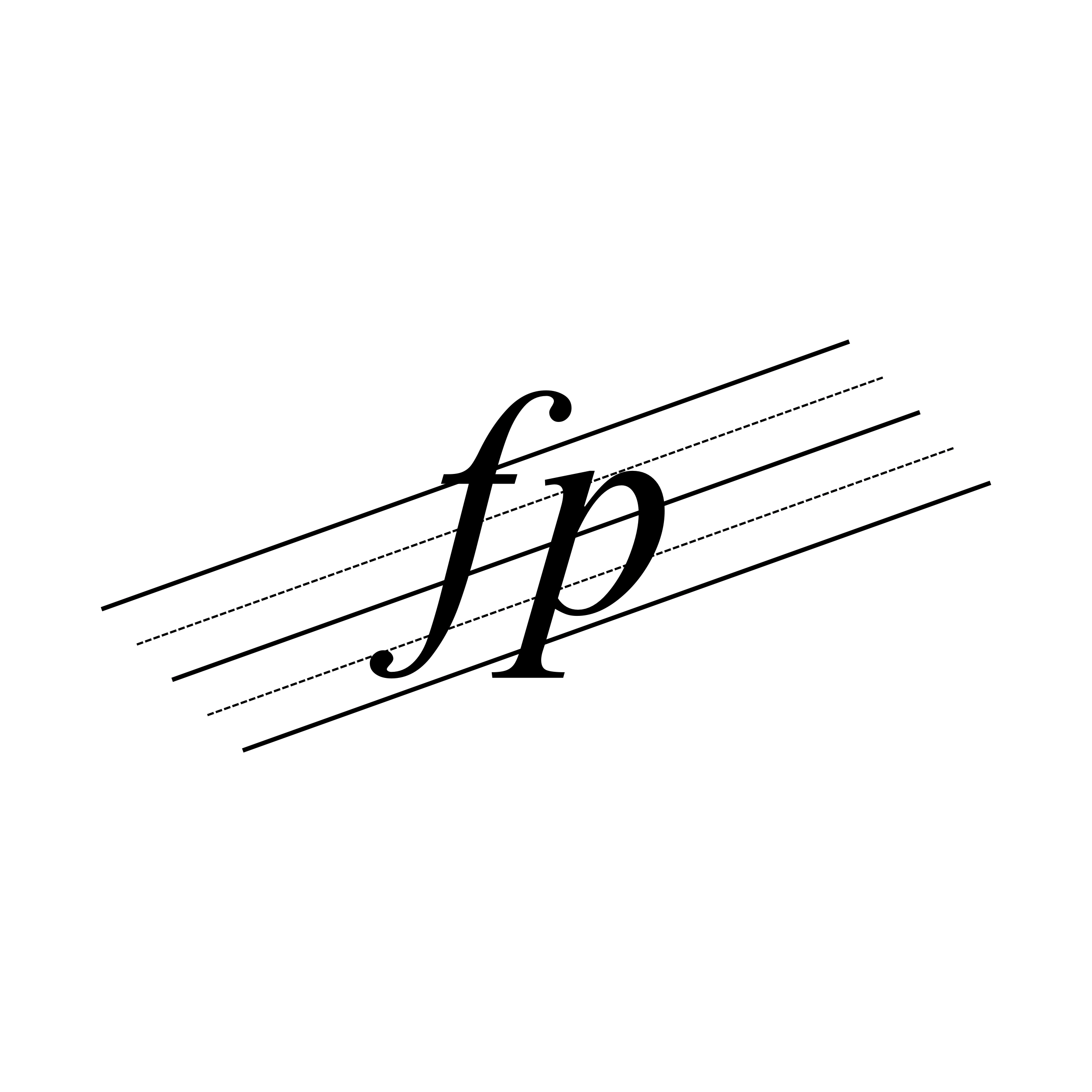

Services Offered: Individual tax preparation, specializing in musicians/performers; Tax consultation.

Hampton Taxes FAQ Sheet

Helpful Links:

Health Insurance Deductions (IRS website)

https://www.irs.gov/taxtopics/tc502

W-2 Write-Offs (FreshBooks website)

https://www.freshbooks.com/hub/taxes/tax-deductions-for-w2-employees

Qualified Performing Artist Form (IRS website)

https://www.irs.gov/instructions/i2106

TOPICS OVERVIEW:

W2 V.S. 1099

Biggest Tax Misconceptions For Musicians

Why You Need To Give A Rat’s Ass About FICA Tax 🥲🐀

Things You Can Write Off! 👏

Things You CAN’T Write Off! 😫

“Qualified Performing Artist” Eligibility

Schedule C Income

Writing Off Your Instrument

Home Office Deductions

How To Track & Write Off Mileage

Meal Write-Offs

School Stipends/Scholarships/1098-Ts Tax Implications

Student Loans & Tax Implications

Medical Bills

Unemployment Income Taxes

Common Tax Credits

Writing Off Equipment/Music/Reed Supplies/Etc.

Keep Track Of Business Expenses

Are Audition Expenses Tax Deductible?

AND MUCH MORE!